Article Directory

Here’s a question for you: What happens when a company tells you it’s building a revolutionary, alpha-generating Bitcoin acquisition platform, but the people running the show are quietly selling their own shares?

You get Strive Asset Management ($ASST).

The recent headlines have been electric. The `asst stock price` rocketed over 20% in a single day, fueled by a dizzying string of announcements: a $1.34 billion all-stock merger with Semler Scientific, the acquisition of a Bitcoin media company, and a C-suite stocked with crypto veterans. The company, which began life as an anti-ESG ETF advisor, has pivoted so hard it’s practically spinning. It now presents itself as the next evolution of the corporate crypto treasury, a smarter version of the `mstr stock` playbook pioneered by MicroStrategy.

On the surface, it’s a compelling narrative. Strive’s CEO, Matt Cole, talks about cementing the company’s position as a “top Bitcoin treasury company” and finding deals that unlock hidden value. They’ve amassed nearly 11,000 BTC, worth around $675 million. For the retail investor, seeing the `strive stock` surge on this news — $ASST stock is up 22% today. Here's what we see in our data. — feels like validation. It feels like getting in on the ground floor of the next big thing.

But my job isn’t to get swept up in the narrative. It’s to look at the numbers. And when you start digging into the data behind Strive, a very different, far more complicated picture emerges. One that every investor needs to see.

Two Conflicting Signals

Let’s start with the story the company is selling. The merger with Semler Scientific is the centerpiece, a deal that valued Semler at $90.52 per share (a 210% premium over its previous trading price, which is just staggering). This move alone brought 5,816 BTC onto Strive’s balance sheet. They also scooped up True North Inc., a media platform, and appointed its founder as Chief Risk Officer. It all looks like aggressive, forward-thinking expansion. Cole’s goal is to “increase Bitcoin per share,” a metric that sounds fantastic in a press release.

The strategy is to use company equity as a currency to acquire Bitcoin and Bitcoin-related assets, theoretically faster than the dilution from issuing that equity hurts existing shareholders. It's a high-stakes arbitrage play on their own stock. They are trying to be the Berkshire Hathaway of the blockchain, as one investor optimistically put it.

But then there’s the other signal—the one that doesn’t make it into the flashy headlines.

While the company is telling the world to buy into its vision, the insiders are selling. Open market data from the last six months is unambiguous. There have been three significant insider sales and zero purchases. Executive Chairman Michael Gaubert sold 30,000 shares. CFO Matthew Krueger has sold over 26,000 shares in two separate transactions. These aren’t minor trims; we’re talking about nearly half a million dollars’ worth of stock being offloaded by the two people who should have the clearest view of the company’s future.

So, here’s the obvious question: If this is a “transformational” moment that will “cement Strive’s position,” why are the executives reducing their exposure?

This brings us to the engine powering this entire strategy: dilution. Strive isn’t using debt; it’s funding everything by issuing new shares. On October 10, the company filed to register 1.28 billion new shares for potential sale. I've analyzed hundreds of filings related to share offerings, and the scale of this one—relative to the company's public float—is the kind of move that makes you sit up and re-read the document twice.

The market’s reaction was immediate and brutal. Imagine watching the ticker after hours as the stock crashed 32%. That’s not a dip; it’s a catastrophic loss of confidence, a direct response to the realization of how much current shareholders’ stakes were about to be watered down.

This creates a paradox that sits at the very heart of the `strive inc` thesis. The company's growth is directly funded by a mechanism that devalues the holdings of its existing investors. It’s like a ship captain trying to build a bigger, faster vessel by prying off planks from the hull and selling them for cash to buy a new sail. You might get the new sail, but you’re also taking on a lot of water. The entire model is a race—can they acquire assets faster than they sink the per-share value?

The Volatility Machine

When you strip away the corporate jargon, Strive is a leveraged bet on the `bitcoin price`, but with extra steps and extra risk. Analysts have noted that stocks like this can move four to five times as much as Bitcoin itself. A minor 5% drop in BTC could easily trigger a 20% collapse in the `asst stock price`. The company is already operating at a loss, with a negative EPS of -$0.04. It has no debt, which sounds good, but it also means equity is its only tool, making relentless dilution a near certainty.

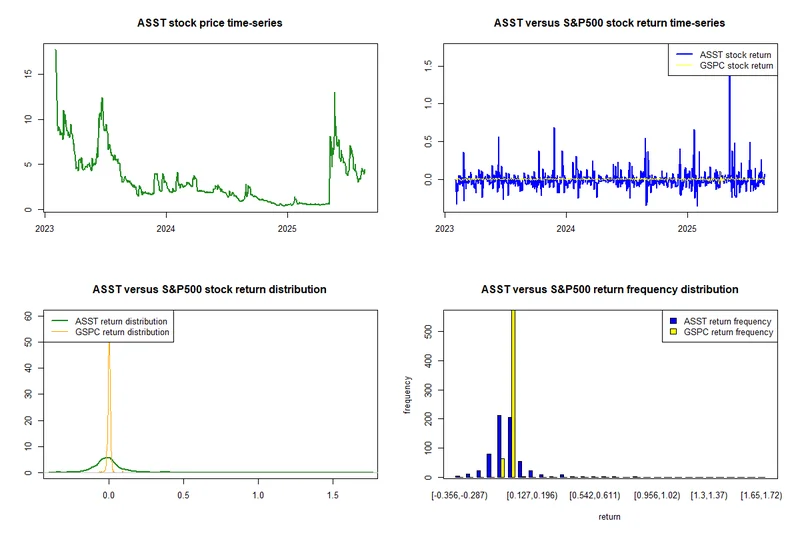

The trading activity reflects this chaos. The stock has swung from $0.34 to $13.42 in the past year. The recent 200% surge in trading volume isn't necessarily institutional conviction; it’s a frenzy of speculation, much of it playing out on forums like `asst reddit`. Retail traders are chasing the narrative, drawn in by the massive price swings and the promise of a crypto moonshot.

But with no major Wall Street coverage and no consensus price target, investors are flying blind, guided only by press releases and market sentiment. The company’s own filings are packed with warnings about forward-looking statements and the immense risks involved.

What does this all mean for what happens next? The upcoming earnings report on November 13 will be critical. Investors will be looking for any sign that the company’s acquisitions are generating real value, not just paper gains on its Bitcoin holdings. They’ll be scrutinizing cash burn and any new share issuance plans.

Can Strive actually beat Bitcoin’s returns, as it claims? Or is it simply a highly volatile proxy for crypto, wrapped in a corporate structure that systematically transfers wealth from existing shareholders to new ones to fund its operations? The data, particularly the insider sales, suggests a profound lack of conviction from the people who should be the most confident.

The Math Is The Message

Ultimately, the story of Strive Asset Management is a battle between a seductive corporate narrative and cold, hard numbers. The narrative is about innovation, strategic acquisitions, and becoming a new kind of financial institution. The numbers, however, tell a story of extreme dilution, negative earnings, and insiders who are voting with their wallets by selling shares. When narrative and numbers diverge this sharply, my experience tells me to trust the numbers. The math is the message, and right now, it’s sending a clear warning.