Article Directory

Of course. Here is the feature article, written from the specified persona of Julian Vance.

*

# JPMorgan's Earnings Beat Is a Classic Market Head-Fake

There’s a particular kind of quiet that settles in an analyst’s office before the market opens, just as the first trickles of earnings data begin to populate the terminals. It’s a moment of pure signal, before the noise of opinion and reaction floods the airwaves. This morning, the signal from JPMorgan Chase was unequivocally strong. The noise that followed was, to put it mildly, a study in contradiction.

JPMorgan posted its Q3 2025 earnings, and by any objective measure, the results were excellent. Diluted earnings per share came in at $5.07, handily beating the Wall Street consensus of $4.85. Revenue hit $46.43 billion against an expected $45.47 billion. These aren’t rounding errors; they are decisive beats that signal robust operational health. The year-over-year growth is even more telling—a 16.02% jump in EPS from the same period last year.

So, the logical next step in this sequence should be a corresponding bump in the stock price, right? A reward for exceeding expectations. Instead, JPM stock dipped 0.43% in pre-market trading. It’s a small move, but its direction is what matters. It tells a story of a market that looked at a stellar report card and, for some reason, frowned. This is the kind of discrepancy that demands a closer look, because it suggests the market is pricing in a narrative, not the numbers on the page.

The Anatomy of a Beat

Let’s be precise about the data. The bank’s performance wasn’t just a fluke in one division. The revenue climb was strong at 8.9% year-over-year—to be more exact, it was substantially driven by a 9% increase in Banking & Wealth Management revenue. The fact sheet attributes this to higher net interest income on higher deposit margins. In simple terms, the core business of banking is performing exceptionally well in the current environment. This isn’t a story of clever accounting or a one-off asset sale; it’s a reflection of fundamental strength.

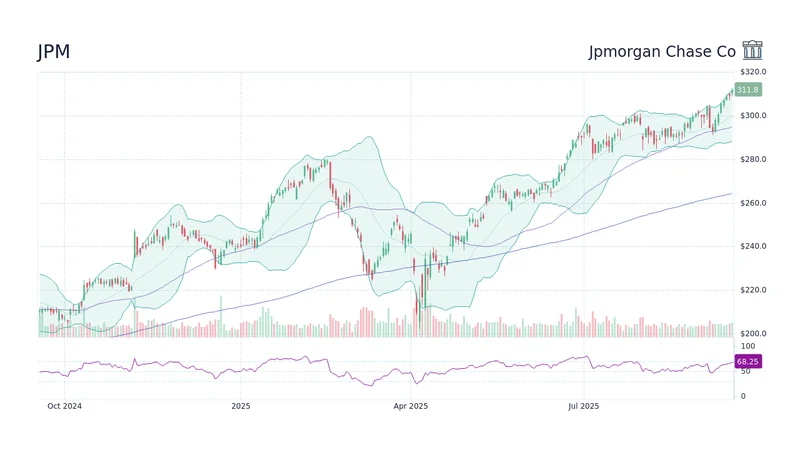

The stock has already had a formidable run, up 31.2% year-to-date and over 38% in the last 12 months. The pre-market dip (especially following a 2.35% rally the day before) indicates that the market had already priced in a strong performance, and perhaps something more: a dose of unbridled optimism from the company’s leadership.

Instead, it got a dose of classic Jamie Dimon realism. His commentary is where the narrative begins to diverge from the spreadsheet. He acknowledged the U.S. economy’s resilience but immediately pivoted to the headwinds: “a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation.”

This is the crux of the disconnect. The market is behaving like a hypersensitive smoke detector that ignores the smell of a perfectly cooked meal to fixate on the single, tiny wisp of smoke it produces. The meal is the $46.43 billion in revenue. The wisp of smoke is Dimon’s entirely predictable and responsible risk management commentary. I've looked at hundreds of these earnings calls, and this particular brand of CEO hedging is standard procedure. Why, then, did the market treat it as new, market-moving information?

When Sentiment Overrides the Spreadsheet

The market is supposed to be a forward-looking mechanism, but here it seems to be selectively so. It’s ignoring present, quantified strength to fixate on future, unquantified risks. Dimon’s job is to steer a multi-trillion-dollar institution through potential storms; of course he’s going to point out the clouds on the horizon. But the market’s reaction suggests it believes the ship is already taking on water, even as the crew reports record-breaking speed.

This is where we have to ask a difficult question: Is the algorithm broken? High-frequency trading models are designed to parse text and sentiment from statements just like Dimon’s. Did they overweight cautious keywords and underweight the hard financial data that preceded them? Is this a momentary, machine-driven overreaction, or does it reflect a deeper, more pervasive anxiety among human investors?

Wall Street’s own analysts seem caught in this same limbo. The consensus rating for JPM is a “Moderate Buy,” a curiously lukewarm assessment for a company firing on all cylinders. This rating is based on 13 Buys and five Holds. That cluster of "Hold" ratings is telling. It’s the analytical equivalent of a shrug—an admission that the data looks good, but the "vibe" feels off. The average price target of $330 represents a potential upside of just 7.15%. In an environment of persistent inflation, that’s barely a real return. It suggests analysts are just as spooked by the macro narrative as the trading bots.

What are we to make of this? Are these analysts simply lagging, waiting for a few days to pass before they upgrade their targets based on the new data? Or do they genuinely believe that Q3 2025 represents a definitive peak for JPMorgan, and that the only way from here is down? The lack of conviction is palpable.

The Signal and the Noise

Ultimately, an investor’s job is to separate the signal from the noise. The Q3 earnings report is a clear, unambiguous signal of financial strength and operational excellence. The pre-market dip, the cautious analyst ratings, and the market’s fixation on boilerplate CEO warnings—that is the noise. The market has performed a classic head-fake, looking one way while the fundamental reality points in the other. For those who prioritize data over drama, this kind of momentary, fear-driven inefficiency isn’t a warning sign. It’s an opportunity.