Article Directory

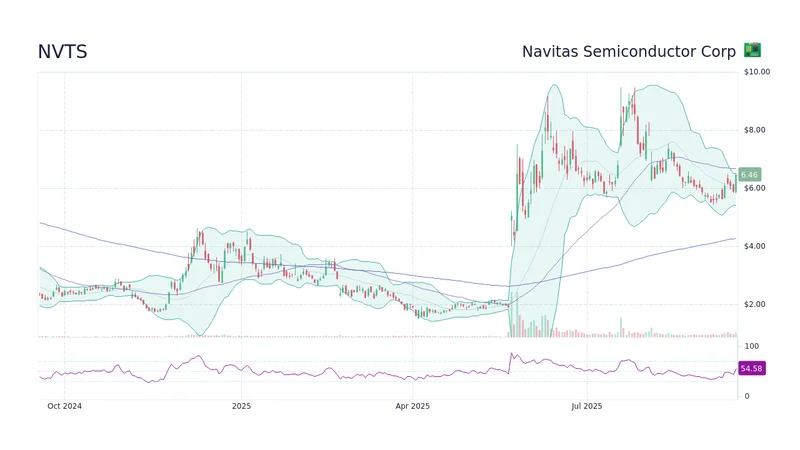

Let’s get one thing straight. The current `nvts stock price` has absolutely nothing to do with reality. Zero. It’s a fever dream cooked up by a market that’s so desperate for the next AI play it would bid up a lemonade stand if it spray-painted "GPU-accelerated" on the sign.

Navitas Semiconductor is a company with about $50 million in annual revenue—which, by the way, is down 40% year-over-year—that is somehow worth over $2 billion. Read that again. Their sales are shrinking, they are losing a boatload of money, and Wall Street has decided they’re the next big thing.

Why? Because they uttered the magic words: "We're working with NVIDIA."

That’s it. That’s the whole story. It’s like a B-list actor getting a single line in a Marvel movie and suddenly their agent is demanding $10 million a picture. The market has completely lost its mind.

The Holy NVIDIA Anointing

The catalyst for this madness was the Navitas Unveils 100V GaN FETs for NVIDIA 800VDC AI Factory announcement. The CEO, Chris Allexandre, called the shift to 800V "not just evolutionary, it’s transformational."

Let me translate that corporate-speak for you: "Please, God, let this NVIDIA partnership make you forget that we’re currently a tiny, unprofitable company whose core business is struggling."

This is the new playbook. You don't need profits. You don't even need growing revenue. You just need a story. And right now, the only story that sells is AI. It doesn't matter if you're making chips like `amd stock` or just the power plugs that go into the wall; as long as you can plausibly connect your company to the AI boom, your stock goes up. It's a gold rush, and Navitas is selling some very, very expensive shovels.

But here’s the part everyone seems to be ignoring. Navitas isn’t the only one with an NVIDIA partnership. Giants like ON Semiconductor and Infineon are also in on the 800V architecture. These are behemoths with deep pockets and established manufacturing. Navitas is a gnat trying to compete with elephants for the same peanut.

So what makes Navitas so special? Is their tech truly that much better? Or are they just the purest, most speculative way to bet on this specific niche? I'm leaning toward the latter. This ain't investing, its a gamble on a longshot.

A Balance Sheet vs. a Fairy Tale

If you actually bother to look at the numbers—and I know, that’s a quaint, old-fashioned thing to do—the picture gets even uglier. Navitas is burning through cash. Analysts don’t expect them to be profitable until 2027, if ever. Their revenue for the next quarter is guided to be a measly $10 million. Ten. Million. For a company valued at two billion dollars.

This is a classic hype cycle. No, 'classic' doesn't do it justice—this is a masterclass in narrative warfare. The stock is trading at something like 31 times sales. Not earnings, because there are none. Sales. That’s a valuation that would make a dot-com bubble veteran blush.

The whole thing feels like a lottery ticket. The market is paying today for a potential jackpot in 2027, when the NVIDIA-related revenue might actually start flowing. But what happens in the meantime? What if there are delays? What if a competitor like Wolfspeed or STMicroelectronics beats them on performance or price? What if the AI buildout slows down?

The bulls will tell you about their new 8-inch wafers and their pivot away from low-margin consumer junk. Great. Terrific. That's like rearranging the deck chairs on a ship that's still waiting for its engine to be built. The entire `nvts stock forecast` rests on a single, distant hope.

Then again, who knows. Maybe I'm the idiot who screamed that `tesla stock` was a joke at $50 a share. It’s possible. But this feels different. This feels less like a visionary company and more like a perfectly timed press release. The retail crowd on Reddit is betting on a dream, the shorts are betting on gravity, and in the middle is a company that has yet to prove it can actually execute on any of this.

This is the part of the cycle where every company, from `pltr` to some random industrial supplier, suddenly has to invent an AI story or die. It’s exhausting. It’s also how people lose their shirts.

So, You're Buying a Story

Look, I get the appeal. Navitas is a pure-play bet on a critical component of the AI revolution. If they pull it off and become the go-to for GaN and SiC power chips in data centers, the stock price today will look cheap. But that "if" is doing some seriously heavy lifting. You're not buying a business; you're buying a narrative. You're betting that the story is more powerful than the balance sheet. In this market, that bet has been paying off. But trees don't grow to the sky, and hype eventually collides with reality. Caveat emptor.