Article Directory

The market doesn't like surprises. On Friday, it was served a particularly bitter one, sending the S&P 500 down 131 points, the Dow tumbling 624, and the tech-heavy Nasdaq taking the brunt of the hit with a nearly 600-point drop. The proximate cause was a familiar one: Trump threatens to jack up tariffs on China over its new rare-earth controls.

On the surface, this is just another episode in the long-running drama of U.S.-China trade relations. A hostile-sounding post, a knee-jerk market sell-off, and analysts rushing to call it a "white-knuckle moment." But to focus on the tweet and the tariffs is to mistake the tremor for the earthquake. The real story isn't the threat of retaliation; it's the calculated action that provoked it. China’s new export controls on rare-earth elements are not just another trade tactic. They represent a fundamental shift in the strategic landscape, and the market’s panicked reaction suggests it’s only just beginning to price in a risk it has ignored for over a decade.

The Dragon Tightens Its Grip

Let’s be precise about what Beijing actually did. This wasn't a crude embargo. The new rules, which took effect Thursday, are far more sophisticated. They require companies to obtain special approval to export any product containing even trace amounts of rare earths sourced from China. The most critical clause? This applies even if those products were manufactured abroad by non-Chinese companies.

This is the part of the policy that I find genuinely puzzling in its audacity. It’s an assertion of jurisdictional oversight that extends far beyond China's borders. Think of it this way: China isn't just controlling the crude oil coming out of its wells. It’s claiming the right to control any gasoline, plastic, or chemical product made anywhere in the world if it originated from a single drop of their oil. It’s a breathtakingly bold move to weaponize not just a commodity, but the entire downstream supply chain that depends on it.

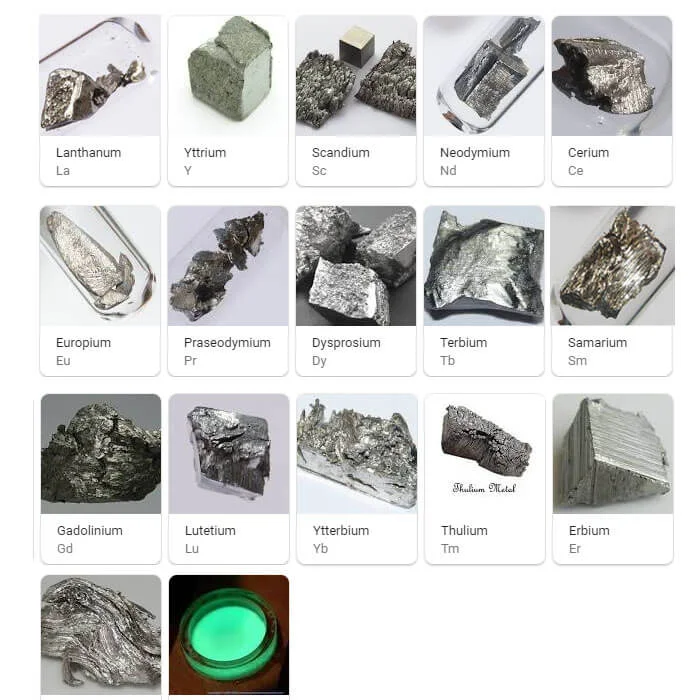

The leverage here is immense, and the data is unambiguous. According to Wood Mackenzie, China is responsible for up to 95% of the world's production of rare earth magnets—the critical components in everything from F-35 fighter jets and EV motors to the tiny actuators in your smartphone. For years, this was just a statistic in a research report. Now, it's an active choke point. Beijing has moved from passive dominance to active control. The question is no longer if they will use this leverage, but how and when. Are these new controls merely a negotiating tactic to be bargained away, or are they the opening move in a much longer game of strategic denial?

The English translation of the rules conveniently omits specific penalties, a classic example of strategic ambiguity. It creates maximum uncertainty for corporate legal and compliance departments, forcing them to be maximally cautious. This isn't about halting trade; it's about forcing the world to ask for permission.

A Fever Chart of Misdirection

The market’s reaction was immediate and, frankly, predictable. The Nasdaq fell about 2.6%—to be more exact, 2.59%—as investors correctly identified the tech sector as ground zero for this supply chain shock. Dan Ives of Wedbush noted that "tech stocks are under major pressure," which is accurate but misses the larger point. The pressure isn't just from the threat of tariffs; it's from the sudden, terrifying realization of absolute dependency.

President Trump’s response, describing the move as "very hostile" and threatening tariffs, is the kind of symmetric retaliation that markets understand. It fits the established script. But tariffs are a tool for trade disputes over things like steel or soybeans, where alternative suppliers exist. Using tariffs to counter the restriction of a resource you are almost entirely dependent on is like threatening to raise the price of water for the only person with a well in the desert. The leverage is entirely one-sided.

This is where the analysis needs to go deeper than the daily market chatter. The S&P 500’s dip (a fall of 1.96%) is a reaction to a potential hit on corporate earnings from a renewed trade war. But what if the market is pricing in the wrong risk? The real danger isn't that a few percentage points of tariffs will make iPhones more expensive. The real, systemic risk is that the components needed to make an iPhone, an electric vehicle, or a missile guidance system might not be available at any price without Beijing’s explicit approval.

We have a framework deal announced in June that was supposed to de-escalate these tensions, yet here we are. The details of that agreement were always vague, but its purpose was to create stability. China's latest move has effectively rendered it moot. So, what changed in their calculation? Did they see the market's AI-fueled froth and perceive a moment of maximum vulnerability for the tech sector? Or is this a carefully timed signal, a reminder of their power ahead of the APEC summit? The "why now" remains the most critical, and unanswered, question.

The Real Deficit Isn't Trade, It's Strategy

Ultimately, this entire episode reveals a profound, and dangerous, misunderstanding in the West. For years, we've focused on the trade deficit, a simple number that's easy to politicize. But the far more important deficit is a strategic one: the decades-long failure to secure a resilient supply chain for the most critical materials of the modern economy. Trump's threat to raise tariffs is a loud and theatrical response, but it’s aimed at the wrong target. You cannot tax your way out of a near-total monopoly. The problem isn't the price of Chinese goods; it's the necessity of Chinese resources. This isn't a trade war that can be won with economic pressure. It’s a geopolitical power play, and the U.S. just discovered it’s holding a very weak hand.