Article Directory

Dogecoin is currently a paradox wrapped in a data anomaly. On one hand, you have traders fixated on microscopic chart movements, debating a pivot point around $0.24 as if it were the fulcrum of the financial universe. On the other, you have long-term forecasts that, as one analysis titled Dogecoin Price: ‘$6.9 Is A Magnet’, Analyst Predicts puts it, treat a target of $6.90 not as a speculative fantasy, but as a "magnet." This bifurcation in analysis—between the immediate, chaotic present and a wildly optimistic, almost mythological future—presents a fascinating case study in market psychology.

The short-term picture is a mess of conflicting signals. One source points to a 50% "flash crash," an event so extreme it hints at systemic failures on major exchanges rather than simple retail panic. Another analyst, "Blockchain Baller," focuses on the so-called Imbalance Zone (IMB) between $0.235 and $0.245, suggesting a "clean manipulation and structure break" could precede a rebound. This is the language of high-frequency chart analysis, where every dip and wick is scrutinized for intent. The price action is described as a battleground, with bulls defending the 50-day simple moving average ($0.24) and bears looking to invalidate the entire bullish setup.

This is where I find the data gets particularly noisy. We're looking at a defense of a price level that is, in the grand scheme of things, statistically insignificant. The narrative is that if Dogecoin can hold this line, it may climb to $0.27 or even $0.29. The risk, however, is a breakdown that sends it back into a prolonged oscillation between $0.14 and $0.29. This is classic technical analysis, useful for defining risk on a short-term trade, but it tells us absolutely nothing about the asset's fundamental value or long-term trajectory. It's like analyzing the brushstrokes on a single square inch of a vast, unfinished canvas. What does it really tell you about the final masterpiece?

The Leap from Pennies to Dollars

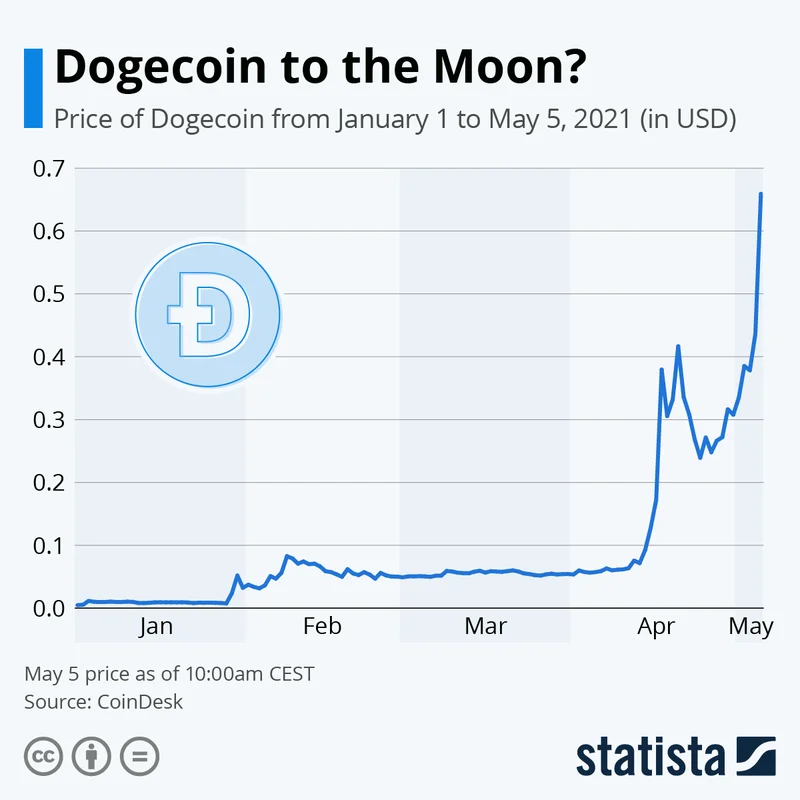

This is where the narrative makes a jarring leap from the tactical to the theological. Analyst Kaleo, among others, isn't concerned with the skirmish at $0.24. He’s looking at a multi-year pattern and drawing a direct, almost deterministic line to a price of $6.90. The logic hinges on a historical correlation: in past cycles, Dogecoin has broken out of long-term descending triangles following a Bitcoin halving, leading to exponential gains. The current chart, he argues, mirrors the setup seen just before the 2021 bull run.

To justify the $6.90 figure, the analysis moves from charts to market cap arithmetic. The core assumption is that Bitcoin will reach a market capitalization of $10 trillion (implying a price over $500,000). If Dogecoin were to capture just 10% of that valuation—a ratio it briefly flirted with during the 2021 mania—its market cap would hit $1 trillion. Based on the current circulating supply, this would translate to a price of approximately $6.94 per coin. That represents an increase of about 3,500%—to be more exact, 3,530% from the $0.19 level cited.

And this is the part of the analysis that I find genuinely puzzling. It rests on two colossal assumptions, both of which are treated as near-certainties. First, that Bitcoin will achieve a $10 trillion valuation this cycle. Second, and far more tenuous, is that Dogecoin will maintain a 10% valuation ratio to Bitcoin. This is like assuming a tugboat will always travel at 10% of the speed of the aircraft carrier it’s escorting, regardless of weather, ocean currents, or the structural integrity of the tugboat itself. The 2021 ratio was an outlier, a moment of peak retail euphoria driven by celebrity endorsements and stimulus checks. Is it a repeatable phenomenon or a black swan event? The data provides no clear answer.

The analysis also conveniently ignores Dogecoin’s inflationary supply schedule. Unlike Bitcoin's fixed supply, Dogecoin adds billions of new coins to the market each year (around 5.2 billion, to be precise). While the inflation rate decreases over time, it’s a constant headwind against price appreciation that these multi-thousand-percent forecasts rarely seem to factor into their models. What happens to the $6.90 target when you account for the tens of billions of new coins that will exist by the time Bitcoin hypothetically reaches $500,000?

AI Joins the Speculation Chorus

Even artificial intelligence is being pulled into the fray. For instance, a report titled DeepSeek AI Predicts Prices for XRP, Shiba Inu, Dogecoin notes that China's DeepSeek AI predicts Dogecoin could close out 2025 in a range between $1.50 and $3.00. The AI points to its deep liquidity, loyal retail following, and strengthening adoption trends, such as its acceptance by Tesla for merchandise. The model notes that DOGE has outperformed Bitcoin and Ethereum over the past year and sees multiple bullish chart patterns forming.

While fascinating, this adds another layer of abstraction to the problem. An AI model is only as good as the data it's trained on. It excels at identifying historical patterns and correlations. But in a market driven by narrative, sentiment, and reflexive feedback loops, historical correlation is not a guarantee of future causation. The AI can see the same patterns Kaleo does, but can it truly weigh the probability of a cultural moment from 2021 repeating itself in a completely different macroeconomic environment? Can it account for the emergence of thousands of new meme coins competing for the same speculative capital?

The community sentiment, which I treat as a qualitative, anecdotal data set, is clearly polarized. One camp is hunkered down, watching 4-hour charts and defending the $0.24 trench. The other is looking at a logarithmic chart, convinced that this is all just prelude to a historic, life-altering rally. The dissonance is palpable. You have one group fighting for a 10% gain while the other is calmly waiting for a 3,500% explosion. Both cannot be right about the market's immediate intention.

A Disconnect Between Signal and Noise

My analysis suggests the current discourse around Dogecoin is less about financial forecasting and more about belief. The short-term technicals are the signal—the quantifiable, immediate reality of supply and demand. The multi-dollar price targets are the noise—a powerful, compelling narrative built on historical analogy and speculative arithmetic. The fundamental discrepancy is that the market's most vocal participants are treating the noise as the primary signal, using it to rationalize their position while largely ignoring the contradictory data from the present. The real question isn't whether Dogecoin will hit $6.90; it's how long this profound disconnect between the chart on the screen and the chart in the imagination can be sustained.