黄金股上涨背后的区块链因素探析

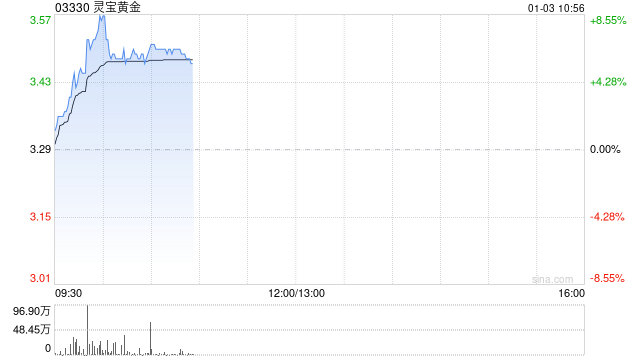

黄金股早盘继续走高,灵宝黄金(03330)上涨5.78%,报3.48港元;紫金矿业(02899)上涨3.53%,报14.68港元;招金矿业(01818)上涨1.75%,报11.62港元;山东黄金(01787)上涨1.19%,报13.60港元。

此次黄金股上涨,除了受国际金价上涨以及市场避险情绪的影响外,我们或许可以从区块链技术的应用角度进行更深层次的解读。

首先,区块链技术可以提升黄金供应链的透明度和可追溯性。传统的黄金交易存在信息不对称的问题,区块链技术可以记录黄金从开采到销售的每一个环节,确保黄金的来源真实可靠,减少造假和洗钱的风险。这对于投资者来说,无疑增加了投资的信心,从而推高黄金股价。

其次,区块链技术可以促进黄金市场的去中心化。传统的黄金交易主要依靠少数大型机构控制,而区块链技术可以打破这种垄断,让更多的投资者参与到黄金交易中来。这将增加黄金市场的流动性,并最终影响黄金股价。

此外,一些公司正在探索利用区块链技术发行黄金数字资产。这些数字资产可以代表实际的黄金储备,投资者可以通过购买这些数字资产来参与黄金市场,这将进一步提高黄金市场的效率和参与度。

当然,区块链技术在黄金领域的应用还处于早期阶段,其发展和普及还需要一定的时间。但是,我们不能忽视其潜在的巨大影响。随着技术的成熟和应用场景的拓展,区块链技术将极大地改变黄金行业的面貌,并为黄金股价的长期上涨提供新的动力。

需要注意的是,股市有风险,投资需谨慎。以上分析仅供参考,不构成投资建议。