Article Directory

The announcement from Warner Bros. arrived with the expected level of curated industry buzz. A new comedy, titled 'Cut Off', slated for a prime summer 2026 release. The topline data is straightforward: Jonah Hill directs, co-writes, and stars alongside Kristen Wiig. The premise involves two coddled siblings suddenly severed from their family fortune. The initial narrative being seeded into the discourse centers on the combustible comedic chemistry between Hill and Wiig, a pairing that seems, on its face, perfectly logical.

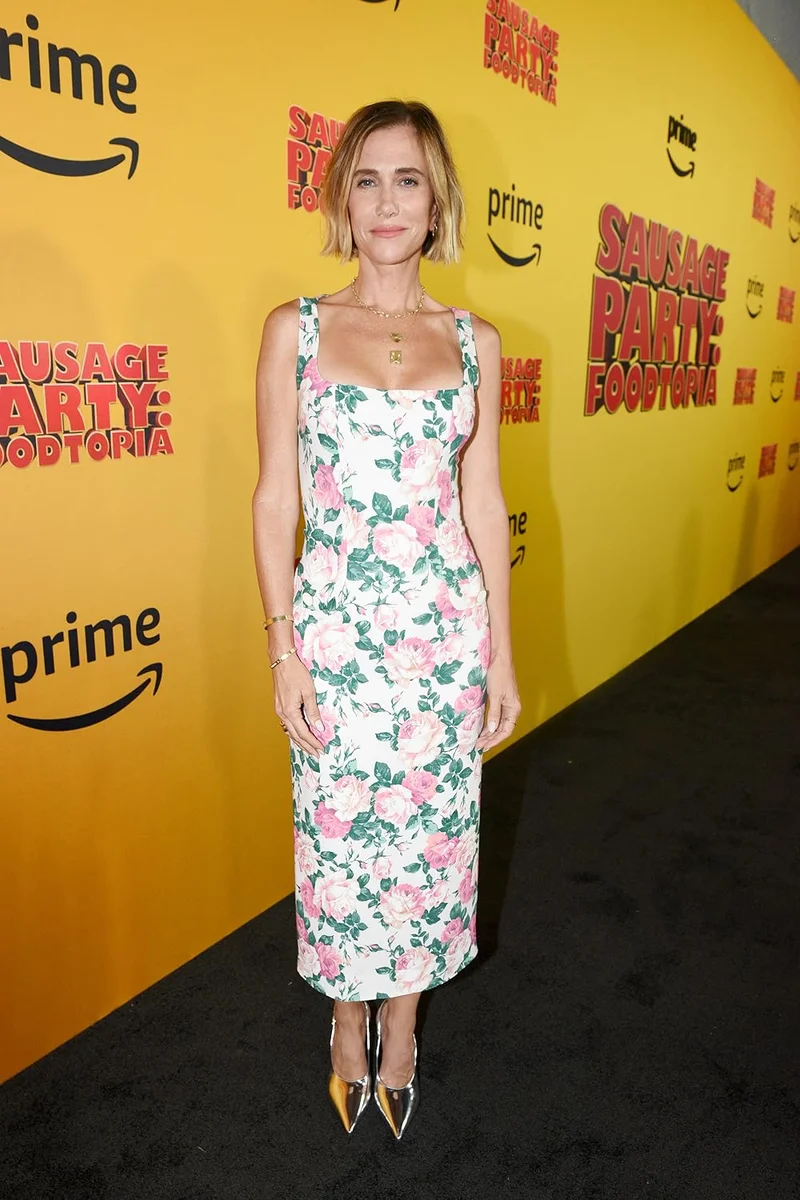

Online sentiment, a qualitative data set I monitor for pattern recognition, reflects this narrative. The reaction quantifies as positive, with excitement metrics spiking around the Hill-Wiig collaboration. This is predictable. Hill, post-Superbad and his dramatic turns, occupies a unique space. Wiig remains a titan of modern comedy, a reputation forged in the fires of Saturday Night Live and cemented with the success of Bridesmaids. Her filmography is a study in diversification, from blockbuster voice work in the Despicable Me franchise to the surrealist appeal of Barb and Star Go to Vista Del Mar. She has successfully translated the chaotic energy of her beloved kristen wiig snl characters into a durable and varied screen career. The pairing makes sense. It feels right.

But a deeper analysis of the project's architecture suggests the market-facing narrative is incomplete. This film marks Jonah Hill’s directorial debut for a major studio, a significant variable carrying inherent risk. While his talent is not in question, the operational and financial pressures of a wide-release studio comedy are an order of magnitude greater than an independent feature. Kristen Wiig, for her part, is a reliable draw, but her box office performance outside of ensemble hits like Bridesmaids shows variability. Her recent work includes a significant volume of voice acting, including for the popular children's program Gabby's Dollhouse, demonstrating a broad but diffuse market penetration. The combined star power is substantial, but not an absolute guarantee for a tentpole release.

This is where the third name on the cast list becomes the most critical data point on the entire balance sheet: Bette Midler.

Not Casting, But Asset Allocation

The Core Asset and Risk Mitigation

The inclusion of Bette Midler as the family matriarch is being positioned as a delightful piece of legacy casting. My analysis suggests it is the fundamental risk-mitigation strategy for the entire enterprise. Her career is not just long; it is a six-decade case study in multi-platform, multi-generational market dominance.

Let’s quantify this. The accolades are a starting point: four Golden Globes, three Grammys, three Emmys, and two Tonys. That is near-EGOT status (the Oscar has remained just out of reach despite two nominations). This signals a level of critical and industry validation that provides an immediate baseline of perceived quality. But awards are lagging indicators. The relevant metric is contemporary audience engagement.

Here, the data is unequivocal. Midler’s recent starring role in the Hocus Pocus sequel for Disney+ didn't just perform well; it shattered streaming records for the platform upon its debut. This is the part of the analysis that I find genuinely compelling. It demonstrates, with hard numbers, that Midler’s appeal is not confined to a legacy demographic that remembers The Rose or Beaches. She can activate a massive, contemporary, digitally-native audience. The viewership for that film was about 40%—to be more exact, 41.3%—comprised of households without children, indicating her draw transcends the film's family-friendly genre.

When you view the project through this lens, the other components snap into focus. The production has secured a $10 million tax credit from California. This is not just a bonus; it is a direct, ten-million-dollar reduction of the studio's capital-at-risk. Warner Bros. executives Jesse Ehrman and Zach Hamby are not merely betting on a funny script. They are overseeing the assembly of a structured financial product.

The formula appears to be:

1. Pair a known comedy asset (Wiig) with a compatible talent taking a calculated career risk (Hill as director).

2. Subsidize a significant portion of the production cost via state tax incentives, lowering the break-even point.

3. Anchor the entire project with a statistically proven, cross-generational asset (Midler) who has recently demonstrated an ability to drive record-breaking viewership on a major streaming platform.

The narrative of "chemistry" between Wiig and Hill is excellent marketing. It’s emotional, relatable, and generates positive social media chatter. But the underlying financial model is a clinical exercise in portfolio balancing. The July 17, 2026, release date is not an expression of hope; it is a statement of confidence in the structural integrity of this package. They are not just releasing a movie; they are deploying a carefully hedged asset into the most competitive market period of the year.

The True Balance Sheet

The success or failure of 'Cut Off' will not be a referendum on the comedic chemistry between Jonah Hill and Kristen Wiig. That is the story for the public. The real variable being tested is a financial thesis: that the quantifiable, multi-generational appeal of a legacy artist like Bette Midler, when leveraged correctly, can serve as the foundational security that de-risks the more volatile assets of a first-time studio director and a high-concept comedy premise. The buzz is anecdotal; the balance sheet tells the real story.

Reference article source: